You only have a limited time frame in which to dispute credit card charges (60–120 days from the statement date). Check your credit card statement for unrecognized charges

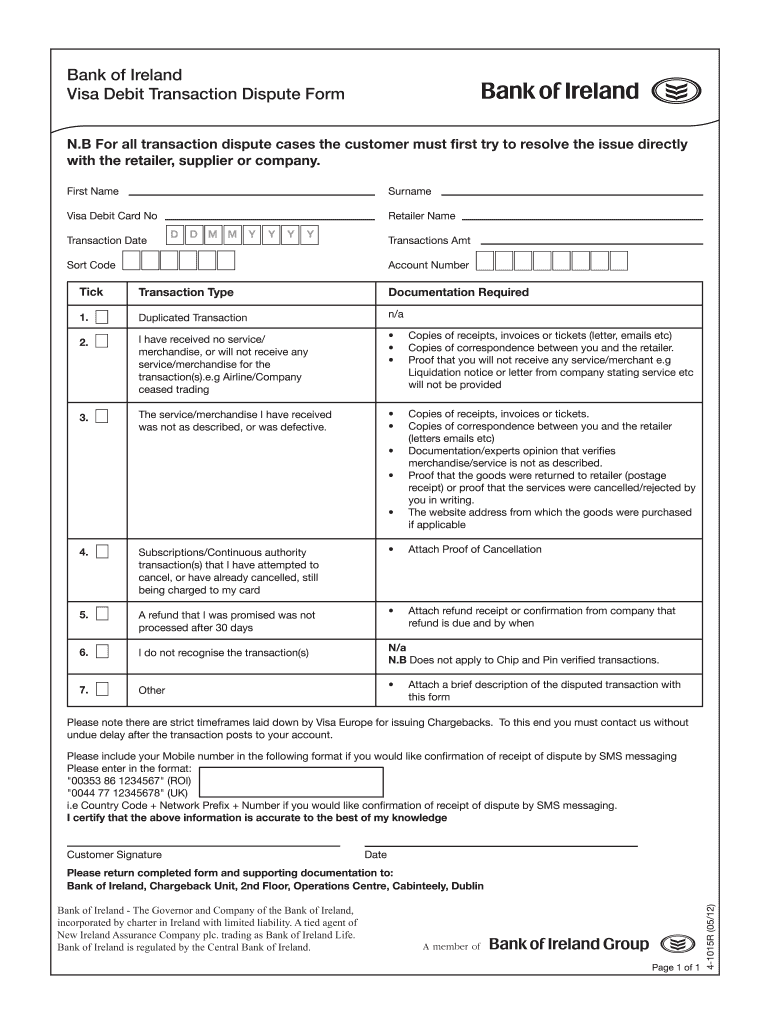

#Chase dispute charge process how to

How To Dispute a Credit Card Charge in 9 Steps In this case, your credit score may increase. In fact, there is a chance that your score will improve.įor example, your dispute could lead to the credit bureau removing some misreported late payments from your credit report. When you file a credit card dispute, it doesn’t have any negative impact on your credit score. Will disputing credit card charges hurt my credit score? If the card company finds the charge is a genuine error, it must correct the transactions and credit your account. But most card issuers often offer zero liability protection. Under Federal law, your liability for fraudulent credit card transactions is limited to $50. If your complaint concerns the quality of goods or services, you have 120 days to lodge a dispute and seek a chargeback. If you find any inaccuracy or questionable transaction on your credit card statement, you must file a dispute with the card issuer within 60 days of the date that the statement was issued.

How Long Do You Have To Dispute Credit Card Charges?

#Chase dispute charge process free

Try Aura free for 14 days and start protecting your finances and identity. ✅ Take action: Get instant notifications about fraudulent transactions or changes to your credit score with Aura’s 4x faster fraud alerts. This means that as long as you make a dispute within the official time limit, fraudulent charges shouldn’t impact your credit score. The FCBA also “prohibits creditors from taking actions that adversely affect the consumer's credit standing until an investigation is completed, and affords other protection during disputes.” If you ask for an explanation of a charge on your credit card bill, it’s possible to overturn the charges if the merchant cannot prove the purchase happened.

A company fails to post payments or credits for a purchase return.Other fulfillment errors include orders that don't arrive or come so late that you no longer want them. Sometimes, you might receive the wrong item or items from a canceled order. You can dispute processing errors, like getting charged for a canceled subscription or receiving a faulty or damaged item. Honest administrative mistakes from lenders might lead to your being billed twice, getting overcharged, or charged via the wrong card or billing address. If your card numbers were used without your permission, you can dispute those charges. Identity thieves buy and sell stolen credit card information on the Dark Web. Unauthorized charges (i.e., credit card fraud).Under the Fair Credit Billing Act (FCBA), all consumers have the right to dispute charges under certain circumstances, including: By lodging a dispute (and providing adequate evidence), you may be able to get a chargeback from the company and merchant involved. When Can You Dispute a Credit Card Charge?Ī credit card dispute is an official complaint process whereby a consumer questions the validity of a transaction on an account. In this guide, we’ll cover what charges you can dispute, how to dispute credit card charges, and ways to protect your credit card from scammers. If you’ve been the target of credit card fraud (or found unfamiliar charges on your statement), acting quickly can limit the damage. Companies are expected to refund over $100 billion in credit card charges in 2023, with 71.5% of all disputes linked to fraudulent purchases. Over the next few days, the 76-year-old victim watched as fraudulent charges kept appearing on her statements.Īs the woman figured out how to dispute a credit card charge, she joined a list of credit card fraud victims that is only getting longer. Has anybody ever stopped to chat with you in the supermarket? For one senior citizen, a brief encounter with another shopper cost her $6,000 after a man approached her to ask about tomatoes and left with her wallet.

Is There a Strange Charge on Your Credit Card Statement?

0 kommentar(er)

0 kommentar(er)